The whole life insurance policy dividend rate is a return earned by an individual who owns a whole life policy.

The policy pays out a periodic payment, called a dividend, to the policyholder regardless of whether the policy is sold or not. In order to qualify for the All Life Insurance Dividends price, the policyholder must maintain the policy and pay the premiums on time.

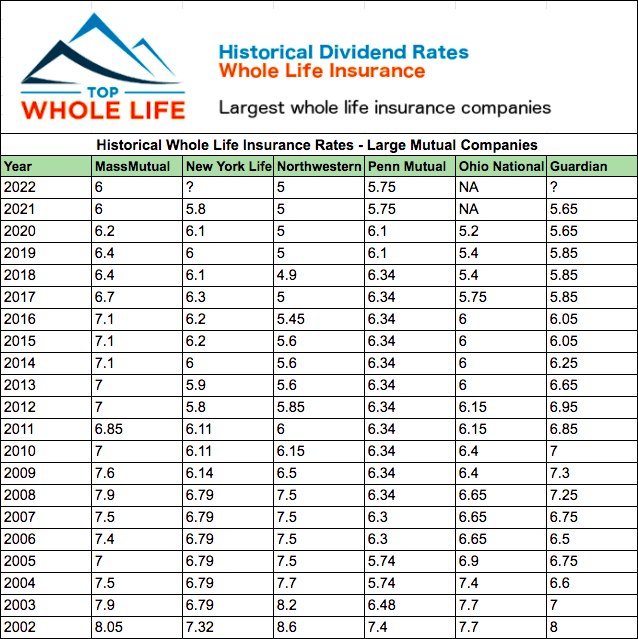

Image source: Google

There are a few different types of policies that offer dividends. The most common type of policy is an individual term life insurance policy. These policies typically have a guaranteed minimum payout and provide a periodic payment, such as a dividend, to the owner regardless of whether the policy is sold or not.

Another type of policy that offers dividends is a universal life insurance policy. Universal life policies allow you to designate beneficiaries for your Policy and receive periodic payments from the Policy regardless of who acquires it after your death.

Whole life insurance policies typically have higher dividends than other types of policies because they have longer terms and higher cash values. Because these policies have high cash values, they can provide substantial returns over time even if premiums are paid on time only occasionally.

Some of the most important factors that influence whole life insurance dividends include:

-The age of the policyholder

-The size of the policy

-The terms of the policy (how long it will continue to offer dividends)

-How well the policy has performed over its lifetime